Corporate Loan

The most crucial thing in business is money. We support business loans with major Middle Eastern banks and partners.

With the required documentation, you can borrow money as a business loan and set your fixed repayment period between 12 and 48 months. Depending on the pricing of the various banks affiliated with the Middle East Biz Center, we help you conclude contracts with banks in the Middle East on the best terms for your loan period.

According to EY (Ernst & Young)’s World Islamic Banking Competitiveness Report 2016, the total assets of Islamic financial institutions in 2014 were USD 88.2 billion, an 80% increase compared to 2010, and growing at an average annual rate of 16%. Growth is mainly driven by GCC and ASEAN countries, where Islamic financial assets accounted for 34% of the total. By country, Saudi Arabia has the most Islamic financial assets, and more than half of Saudi Arabia’s total financial assets are Islamic financial assets (51.2%). It was followed by Malaysia, which held 15.5% of all Islamic financial assets, in second place, and the United Arab Emirates, which held 15.4%, in third place.

For reference, EY’s analysis data above excludes Iran, which operates mainly in the domestic market, and when Iran is combined, Iran is overwhelmingly No. 1 in terms of volume.

Saudi Arabia – The country is the most prominent conservative Islamic state, with 51.2% of Saudi Arabia’s total financial assets being Islamic financial assets.

- Banks : Al-Rajhi Bank, Al Jazeera Bank, Al-Bilad Bank, Alnima Bank (The above four companies operate only 100% pure Islamic financial products)

- Insurance (takaful) : About 40 companies including Alianz Saudi Fransi Cooperative Insurance, BUPA Arabia, AXA Cooperative Insurance, Tawuniya

United Arab Emirates – Although behind Saudi Arabia in terms of overall economy, it is the most vibrant financial center in the Middle East, led by Dubai.

- Banks : ADIB, Al Hilal Bank, Ajman Bank, Dubai Islamic Bank, Emirates Islamic Bank, Noor Bank, Sharjah Islamic Bank

- Insurance (Takaful): About 20 companies including Abu Dhabi National Takaful, Watania, Salama, etc.

Iran

- Since Khomeini’s Islamic Revolution in 1979, along with Saudi Arabia, Islamic law has been firmly applied throughout society. Iran’s industrial growth has been stagnant due to economic sanctions despite its population of 80 million and enormous natural resources. However, with the recent conclusion of the nuclear negotiations, it is a country with the highest growth rate in the Middle East.

- It’s a country that allows only Islamic banking systems along with Sudan. In 1983, it was legislated that only Islamic financial institutions complying with Sharia could operate.

- Iran boasts the world’s largest Islamic financial assets. According to IFSB data, Iran’s Islamic financial assets account for 37.3% of the total, twice as much as Saudi Arabia, which ranks second.

- In 2017, the Central Bank of Iran was nominated to chair the IFSB.

- In 1994, the Tehran local government issued the first Sukuk (Islamic bond) worth US$43 million to build a financial complex.

- In April 2016, immediately after the lifting of economic sanctions, when Iran Fara Bourse, an over-the-counter market in Iran, issued 5 trillion Iranian riyals (US$ 165.5 million) in Sukuk Izara, it was all subscribed within a second after issuance. Fara Bourse publishes Izzara Sukuk, Musharaka Sukuk and Muravaha Sukuk.

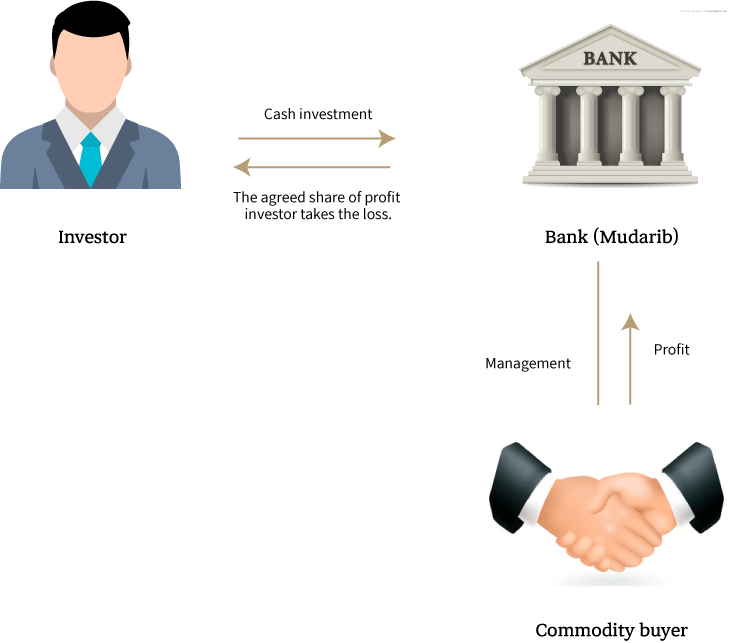

The basic operating structure of an Islamic bank is to invest in the real part by raising funds through an investment deposit structure based on the mudarabah method, a trust deposit structure based on the amanah method, and an agency structure based on the wikala method. Islamic bank financing through investment deposits, trust deposits, and agency structures is characterized by the fact that Islamic banks do not create money in the process of financial intermediation. Islamic banks may face difficulties in liquidity management as they must allocate their capacity to manage real assets as well. The three structures of Islamic banking operations suggest that Islamic banking is characterized by its ability to provide stability as a whole banking system while performance volatility at the individual bank level is high.

Features and benefits

- Hassle-free financing with minimal procedures

- Fair pricing with a promise to maintain the lowest fees and margins in the market.

- Fast decision making and turnaround times, most credit decisions are made within 48 hours.

- Transparency: clear and direct terms and conditions and eligibility requirements

- Flexible repayment terms: Choose repayment terms from 12 to 48 months

Get Consultation

Certification